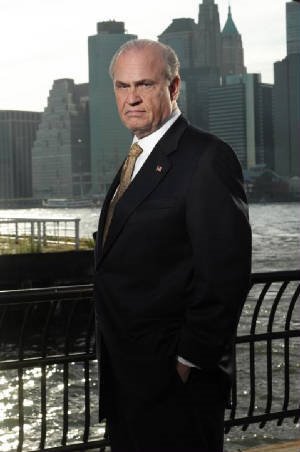

Senator Fred Thompson

On Management Challenges

Facing the Bush Administration

2000

After George W. Bush was elected President, Senator Thompson (then Chairman of the Committee On Governmental Affairs in the U. S. Senate), presented a report called “Management Challenges Facing The New Administration.” This report contains recommendations and advice to the President-Elect on how to deal with financial management issues, federal workforce challenges, and results-oriented government. This is relevant because it gives insight into how a Thompson administration would deal with these national issues, and also, it allows readers to see the vast amount of knowledge Senator Thompson has on government management.

Part I:

FINANCIAL MANAGEMENT ISSUES: This report Senator Thompson gave describes the core capacity problems facing the Federal Government in the year 2000, giving its root causes, and ways of fixing them.

PART 1: FINANCIAL MANAGEMENT ISSUES

INTRODUCTION

On the eve of the upcoming elections and transition to a new Administration and a new Congress, attention centers on policy agendas. However, for our new leaders to succeed with their agendas, they also will need to focus on how the Federal Government executes policy. The work of the Governmental Affairs Committee in recent years points to a series of core capacity problems that pervade the Federal Government and severely limit its ability to implement policies and accomplish its missions. The problems, which are interrelated, include Federal financial management issues, Federal workforce (or ‘‘human capital’’) challenges, and the need for results-oriented governance in the Federal sector.

Capacity problems of the magnitude that face the Federal Government would trigger the immediate and urgent attention of any rational private sector executive. Unfortunately, these problems have festered for years under the radar screens of Federal policymakers.

Continued inattention to these problems will threaten the ability of our new leaders to implement their policy agendas and to provide our citizens the essential services they need and deserve.

As one writer pointedly observed:

[L]ike any good chief executive officer, the President can ill afford to ignore some of the less sexy—but no less important—issues that plague the Federal Government. Tackling problems with the employee merit system, improving agency performance and implementing information technology management reforms won’t get George W. Bush or Al Gore on the front pages of The New York Times or The Washington Post. But ignoring them could.1 The extent of the capacity problems facing the Federal Government is not open to serious question. These problems have been documented repeatedly by the General Accounting Office (GAO), agency Inspectors General (IGs), and other objective sources. The problems are not ideological or partisan. They pose the same obstacles to achieving policy objectives of the left or the right, of Republicans or Democrats. Therefore, resolving them should be a priority for the next Administration and Congress regardless of their political makeup.

Daunting as many of the problems may be, they are solvable. In most cases, it is clear what needs to be done. The main challenge is mustering the will to resolve them and the commitment to follow through until the job is done. The solutions usually center on sustained attention and cooperation by both the Executive Branch and Congress. While some additional legislation may be necessary, our statute books already contain the basic tools to do the job. Targeted funding often will be needed. However, the necessary investments, even when substantial, pale in comparison to the waste that can be eliminated and the performance improvements that can be obtained. Senator Fred Thompson, Chairman of the Governmental Affairs Committee, issues this series of transition reports to focus on the three core capacity problems that will face the incoming Administration and Congress: Financial Management Issues (Part 1), Federal Workforce Challenges (Part 2), and Results-Oriented Governance (Part 3). These transition reports describe the three problems, discuss their nature and root causes, and propose ways of solving them. The reports are intended to stimulate action on the part of our incoming leaders and provide them a useful framework for this important task.

OVERVIEW AND SUMMARY

This is one in a series of transition reports that describe core capacity problems facing the Federal Government, discuss their nature and root causes, and propose ways of solving them. The reports are intended to stimulate action on the part of the incoming Administration and Congress, and to provide them a framework for this important task. This report deals with the need for results oriented governance at the Federal level. Other reports address Federal workforce challenges and the need for results-oriented governance at the Federal level.

The vast majority of Federal agencies lack financial systems that can provide reliable information on a real-time basis to support policy-making and day-to-day management of Federal operations. Federal financial management problems are deep-seated and challenging. IGs have listed financial management as one of the ‘‘top 10’’ most serious problems facing 21 of the 24 major Federal agencies. Financial management is the direct subject of five of the 26 current GAO ‘‘high-risk’’ problem areas. It is a major contributing factor to many more GAO high-risk and IG top 10 problems. Financial management problems have persisted for years and won’t be solved overnight. The most disturbing aspect of these problems, however, is that we seem to be making little demonstrable progress to resolve them.

More agencies are getting ‘‘unqualified’’ (‘‘clean’’) opinions on their annual financial statements. However, some agencies with huge budgets, are not. Consequently, the Federal Government as a whole is not close to being able to balance its books. Furthermore, according to GAO, the vast majority of Federal agencies lack financial systems that comply with basic statutory requirements or provide reliable information that can be used for day-to-day management.

Indeed, many agencies get clean opinions despite, rather than because of, their financial systems. Getting a clean opinion can mask deficiencies in an agency’s underlying financial systems and divert resources from fixing them. The consequences of these shortcomings go far beyond technical compliance concerns. They result in incalculable taxpayer losses to fraud, waste, and error. They divert Federal benefits and services away from those who legitimately depend upon them. They deprive decision makers of the ability to make informed policy decisions, oversee programs, hold agencies and programs accountable for their performance, and get results for the American people.

For example:

· No one knows how many tax dollars are lost to outright fraud, waste, and other improper payments since the government does not systematically track such losses. However, from the few available sources that do exist, the Committee has documented almost $230 billion in waste. This includes overpayment exceeding $20 billion in just a handful of programs.

· Financial management weaknesses impede the delivery of benefits and services to our citizens. Agencies have trouble getting the right benefits to the right people on a timely basis, or even responding to their inquiries promptly and accurately. The Internal

Revenue Service (IRS) provides billions in tax credits to the wrong taxpayers, while qualifying taxpayers fail to get billions in tax credits to which they are entitled. After taxpayers have settled their cases, IRS often fails to release liens against their property within the deadline prescribed by law.

· Enormous amounts of financial, medical, and other sensitive personal information provided by our citizens are at risk of inappropriate disclosure and use due to massive information security weaknesses and ineffective controls in most financial management systems.

In order to solve these problems, it is essential that the incoming Administration bring a sense of commitment and urgency to the task and that the incoming Congress provide vigorous oversight and support. Our success in resolving the Year 2000 (Y2K) Computer Problem provides a model for addressing other problems. It featured aggressive Congressional oversight, strong and centralized Executive Branch leadership, persistent follow-up with specific performance goals and benchmarks, and support through necessary funding and other resources. We need to bring the same sense of urgency and commitment to resolving financial management and other problems.

An essential first step is that agencies candidly acknowledge the extent and seriousness of the problems. This does not always happen today. Second, neither the Administration nor Congress can be content with the minimal pace of current progress, which tends to feature expressions of good intentions rather than demonstrable results. We need to develop firm commitments for concrete improvements and follow through on them. Third, the new Administration needs to ensure that the Office of Management and Budget (OMB) carries out its central leadership role and statutory responsibilities for improving financial management across the government. OMB has failed to do so in recent years.

Within this overall framework, there are a number of specific actions that can make real improvements in financial management.

As detailed in this report, they include:

· Using the Government Performance and Results Act (‘‘Results Act’’) to establish specific and measurable goals for financial management improvement and to report progress on meeting these goals.

· Systematically disclosing and quantifying major overpayment problems in annual agency financial statements and coupling this disclosure with specific error-reduction targets.

· Enhancing data sharing and verification in order to improve the accuracy of eligibility determinations under Federal programs.

· Systematically addressing and tracking progress to implement GAO and IG recommendations for financial management improvements.

· Adopting financial management ‘‘best practices’’ from leading private sector and government organizations.

· Providing necessary resources and incentives to improve financial management, and imposing real sanctions where remedial action is not forthcoming.

· Using recovery auditing to recoup overpayments and to invest a portion of the proceeds to make improvements that will avoid future overpayments.

STATUS OF FEDERAL FINANCIAL STATEMENTS AND

SYSTEMS

Expectations for sound financial management. Most major Federal agencies have difficulty meeting the minimum expectations of laws designed to ensure sound financial management in the Federal Government. These laws include the Chief Financial Officers

(CFO) Act of 1990, which requires annual financial statement audits, and the Federal Financial Management Improvement Act of 1996 (FFMIA), which calls for agencies to comply with basic accounting and financial management standards. In testifying about the government’s many challenges in meeting these requirements,

a GAO official observed:

[F]rom the outset today, I want to dispel the notion that

this is merely a compliance issue. The expectations in the

CFO Act and the FFMIA are integral to producing the

data needed to efficiently and effectively manage the dayto-

day operations of the Federal Government and provide

accountability to the taxpayers. When Federal agencies

can meet these expectations, they will have achieved what

the Comptroller General has referred to as the ‘‘end

game’’—systems and processes that routinely generate reli-

able, useful, and timely information the government needs

to assure accountability to taxpayers, manage for results,

and help decisionmakers make timely, well-informed judgments.

1

Financial statement results. Unfortunately, we are nowhere close to achieving this ‘‘end game.’’ The Federal Government as a whole cannot pass the annual financial audit required by the CFO Act.

Such an audit is the staple of any private sector business. For the last 3 fiscal years, GAO has issued a ‘‘disclaimer’’ opinion on the consolidated financial statements of the U.S. Government. That means that the government’s financial statements do not provide reliable information for decisionmakers or the public. GAO identified ‘‘over $350 billion of adjustments and reclassifications’’ that had to be made in order to reconcile information used to prepare the government’s fiscal year (FY) 1999 financial statements. Even with these adjustments, the books were still out of balance by $24 billion. 2 Some individual agencies likewise cannot pass their own annual financial audits. Fifteen of the 24 major agencies received ‘‘unqualified’’ audit opinions for FY 1999. Four agencies—Education, Justice, Treasury, and the Environmental Protection Agency (EPA)—received ‘‘qualified’’ opinions. Five agencies—Agriculture, Defense, Housing and Urban Development (HUD), the Office of Personnel Management, and the U.S. Agency for International Development—received ‘‘disclaimer’’ opinions. While these results are a net improvement over FY 1998, they fell well short of OMB’s goal. Furthermore, two agencies (EPA and HUD) regressed from their FY 1998 opinions.

Clean audit opinions are only the start. While getting a ‘‘clean’’ audit opinion is important, this alone does not evidence sound financial management. A clean opinion simply means that an agency’s financial information is accurate as of one day of the year—the last day of the fiscal year. It provides no assurance that the agency can actually produce and use reliable financial data on a real-time basis. In fact, it normally takes Federal agencies 6 months after the close of the fiscal year to establish the accuracy of their balance sheets as of the last day of the prior year. Some agencies cannot even meet this 6-month statutory deadline. Furthermore, the Comptroller General testified that some agencies were able to get clean opinions only through what he described as ‘‘heroic efforts.’’ These efforts entail painstakingly reconstructing basic information about agency spending on programs and activities. Their financial systems could not routinely provide this information. Indeed, he went on to say, ‘‘Agency financial systems overall are in poor condition and cannot provide reliable financial information for managing day-to-day government operations and holding managers accountable.’’ 3

A clean opinion actually can be misleading by masking deficiencies in an agency’s underlying financial systems. For example, GAO notes that the Transportation Department’s core accounting system was not the primary source for the financial data that lead to its clean opinion. Because its core system was so unreliable, the

Department had to make about 800 adjusting entries totaling $36 billion to get its ‘‘clean’’ opinion. 4 Furthermore, time-consuming and ad hoc efforts to get clean opinions can be counter-productive since they divert agency financial managers from fixing the underlying problems. GAO states:

The extraordinary efforts that many agencies go through

to produce auditable financial statements are not sustainable

in the long term. These efforts use significant resources

that could and should be used for other important

financial-related work. 5

The Department of Health and Human Services (HHS) and the IRS were other agencies that got clean opinions only through time-consuming, manually-intensive, and error-prone processes that involved billions of dollars of adjustments. The Education Department is still another example of an agency whose ostensible progress for FY 1999 was generally the result of time-consuming and ad hoc efforts rather than genuine improvements in its financial systems. Education received a ‘‘qualified’’ opinion on its financial statements for FY 1999, which is better than the ‘‘disclaimer’’ opinion it got for FY 1998. However, the Department’s internal control problems actually worsened in FY 1999. For example, Education misreported $7.5 billion in its FY 1999 accounts; failed to remit to the Treasury $2.7 billion in collections from its Federal Family Education Loan Program (FFELP) as required by law; and had a discrepancy of $700 million in its FFELP account balance. Also, continued weaknesses in security controls exposed Education’s sensitive grant and loan data to deliberate or inadvertent, misuse, destruction, or improper disclosure. 6

The true test of financial management fitness. Annual compliance audits under FFMIA provide the best indication of whether agencies can produce the data needed to manage their day-to-day operations efficiently and effectively. However, 21 of the 24 major agencies failed to substantially comply with FFMIA standards for FY 1999. 7 The FY 1999 FFMIA results represent no improvement whatsoever over FY 1998, when the same 21 agencies failed their FFMIA audits. They represent a step backward from FY 1997, when 20 agencies failed. In summary, the GAO report on FFMIA results for FY 1999 observes that, for 3 straight years now, ‘‘the vast majority of agencies’ financial management systems fall short of the CFO Act and FFMIA goal to provide reliable, useful, and timely information on an ongoing basis for day-to-day management

and decision making.’’ 8

An important feature of FFMIA is the requirement that non-compliant agencies develop ‘‘remediation plans’’ to describe what actions they will take to fix their problems and come into compliance. However, GAO found that the majority of agency remediation plans were inadequate and had improved only slightly over FY 1998. According to GAO, ‘‘many plans still lacked detailed steps, target dates, and descriptions of the resources needed for executing the corrective actions.’’ Two of the 21 agencies found to be non-compliant (the Federal Emergency Management Agency and the Social Security Administration) did not submit remediation plans at all because they disagreed with the finding of non-compliance. 9

GAO also reported that OMB failed to meet its statutory obligations under FFMIA. When an agency determines, contrary to an audit finding, that it does comply with FFMIA, the law requires OMB to review the agency’s determination and report on the findings to appropriate Congressional committees. GAO states that ‘‘OMB is not reviewing and has not reviewed such determinations in order to report to the Congress.’’ 10

EXTENT AND CONSEQUENCES OF FINANCIAL

MANAGEMENT PROBLEMS

Scope of the problems. GAO has designated financial management as a high-risk problem at the Defense Department, the Forest Service, the Federal Aviation Administration, and the IRS. IG’s have designated financial management a top 10 management problem at all 24 major agencies except the Energy Department, the

General Services Administration, and the Social Security Administration.

The following examples illustrate the impact of these problems

at two agencies.

IRS. Financial management problems at IRS contribute to four separate GAO high-risk areas. Clearly, IRS auditors would come down hard on any business or individual taxpayer who kept their books and records as poorly as IRS does. A recent GAO audit identified IRS accounting errors that, if uncorrected, would have caused a misstatement of over $100 million in the agency’s financial statements for FY 1999. GAO’s audit also revealed serious internal control problems, such as the following:

· Delays of over 10 years in posting payments made by taxpayers to their accounts.

· Failure to offset refunds to taxpayers against their outstanding tax liabilities. In one case, IRS paid a refund of $15,000 to a taxpayer who owed almost $350,000 in back taxes.

· Delays in correcting erroneous tax assessments resulting from data input mistakes. In one case, it took IRS 18 months to correct an input error that resulted in an assessment of over $160,000 against a taxpayer who was actually due a refund. IRS apparently knew the assessment was erroneous 10 months before it was corrected.

· Delays in releasing property liens against taxpayers. In 25 percent of cases examined by GAO, IRS failed to release its liens against taxpayers who had settled their tax liability within the statutory deadline. In one case, IRS had not released its lien 14 months after settlement with the taxpayer. 11

The Defense Department (DOD). DOD is the most deficient of all agencies in failing to provide basic financial accountability. Financial management at DOD as a whole has been a GAO high-risk problem area since 1995. GAO recently testified:

Material financial management deficiencies identified at DOD, taken together, continue to represent the single largest obstacle that must be effectively addressed to achieve an unqualified opinion on the U.S. Government’s consolidated financial statements. DOD’s vast operations—with an estimated $1 trillion in assets, nearly $1 trillion in reported liabilities and a reported net cost of operations of $378 billion in fiscal year 1999—have a tremendous impact on the government’s consolidated financial reporting.

To date, no major part of DOD has yet to pass the test of an independent audit; auditors consistently have issued disclaimers of opinion because of pervasive weaknesses in DOD’s financial management systems, operations, and controls. 12

One major source of these problems is the cacophony of non-integrated systems that DOD tries to operate—168 separate systems in all.

It is virtually impossible to operate rationally in such a morass. Indeed, during FY 1999, DOD spent almost one-third of all its contract payments to make adjustments to previous contract payments.

Overall, the IG found that DOD had to make $7.6 trillion in accounting adjustments in order to prepare its financial statements. Countless items fall through the many cracks in these systems. In 1999, GAO reported that the Navy wrote off more than $3 billion in inventory as ‘‘lost in transit.’’ When the Army took an inventory of its assets in 1999, it found 56 airplanes, 32 tanks, and 36 Javelin command launch units for which it had no records. A visit to one Army ammunition depot found 835 ‘‘quantity and location discrepancies’’ for over 3,000 ready-to-fire, hand-held rockets and rocket launchers obviously, very sensitive items requiring strict controls. DOD data shows that over half the in-hand inventory items it can find, valued at about $37 billion, exceed its current requirements.

Improper payments. One direct consequence of poor financial management is the exposure of taxpayer dollars to massive fraud, waste, and abuse. The work of the Governmental Affairs Committee, based on GAO and IG reports, documents huge losses to our citizens from fraudulent and other erroneous payments of taxpayer funds. Based on a review of improper payments that agencies disclosed in their own financial statements for FY 1998, GAO identified $19.1 billion in improper payments for that year alone.

This report covered only the nine agencies that voluntarily disclosed improper payments for 17 major programs. GAO noted that,while the full extent of improper payments was unknown, ‘‘[i]mproper payments are much greater than have been disclosed thus far in agency financial statement reports, as shown by our prior audits and those of agency Inspectors General.’’ 14

The Committee confirmed that the $19.1 billion figure was only the tip of the iceberg. Adding up wasted taxpayer dollars that had been documented and quantified in various GAO and IG reports, the Committee came up with a cumulative figure of $220 billion in waste, fraud, and abuse. This figure included $35 billion in overpayments.15 The problem of erroneous payments appears to be getting worse. When GAO updated for FY 1999 improper payments disclosed in agency financial statements, the total had grown to $20.7 billion. 16 When the Committee recently updated its analysis of waste documented in GAO and IG reports, the total had grown to almost $230 billion. This included improper payments of over $47 billion. (See the Appendix to this report.) Several programs consistently make billions of dollars in improper payments that represent significant portions of their entire budgets. Examples are Medicare, Supplemental Security Income, and food stamps. Another example is the Earned Income Tax Credit

(EITC). Erroneous EITC payments have been estimated at as much as $9.3 billion annually. This is over 30 percent of all EITC claims, which total about $30 billion annually. At the same time, it has been estimated that as few as 65 percent of eligible taxpayers receive the EITC credit. 17 Given these problems, Congress authorized IRS to spend a total of $716 million over 5 years to improve EITC administration. However, IRS has not established Results Act performance goals to address the EITC problems. It also has failed to provide meaningful outcome data on the impact of the funds provided by Congress to improve EITC administration. 18

Ineffective information security. Weak security controls over sensitive information are a major factor underlying financial management problems. Information security weaknesses affect almost all agencies and constitute a GAO-designated government wide high-risk problem. They place enormous amounts of Federal assets at risk of inadvertent or deliberate misuse, financial information at risk of unauthorized modification or destruction, sensitive information at risk of inappropriate disclosure, and critical operations at risk of disruption. Of the 21 agencies that failed to comply with FFMIA, all had serious weaknesses in the area of information security.

Agencies in denial. We will never generate demonstrable improvements in financial management until agencies forthrightly acknowledge the seriousness of their problems. As the following examples indicate, some agencies are still in denial.

In a recent ‘‘Progress Review and Accomplishment Report’’ by HUD on its ‘‘2020 Management Reforms’’ stated: ‘‘HUD’s once vulnerable financial management system is now reliable, accurate and timely.’’ However, the HUD IG reported that the serious weaknesses in HUD’s financial systems persist today and led to a disclaimer

of opinion on the agency’s financial statements for FY

1999. 19

An Education Department spokesperson recently stated:‘‘ Our position is that we have adequate financial controls in place to provide for the smooth operation of our financial systems here at the Education Department.’’ 20 That position is not shared by the agency’s IG or GAO. The IG listed ‘‘long-standing problems with financial management’’ as the number one management challenge facing the Department. 21 Likewise, GAO recently testified that Education ‘‘has experienced persistent financial management weaknesses’’ for years and that these ‘‘serious internal control and financial management systems weaknesses continued to plague the agency’’ during

FY 1999. 22

Student financial aid programs have been included on GAO’s high-risk list since its inception in 1990. However, Education’s commitment to resolving these problems appears questionable. GAO expressed concern that the Education Department’s Office of Student Financial Assistance, which was recently reconstituted as a so-called ‘‘performance-based organization,’’ has not established any performance goals to resolve the problems that make its programs high-risk. 23 In 1998, Congress enacted a law designed to enable Education to verify income information with IRS as a means of enhancing student assistance eligibility determinations. 24 This law remains unimplemented nearly 2 years after its enactment, while Education, Treasury, and OMB engage in seemingly intractable discussions over what to do.

OMB is in the forefront of agencies in denial. OMB’s own performance report for FY 1999 seriously overstated the number of agencies that got clean audit opinions. It criticized GAO’s report on massive FFMIA non-compliance, discussed previously, as being too negative and failing to ‘‘acknowledge that the agencies are moving steadily in the right direction.’’

GETTING TO SOLUTIONS: AN OVERALL FRAMEWORK

Solving financial management problems starts with an overall framework that applies equally to most of the Federal Government’s other core capacity problems. The model for this framework can be found in the successful resolution of the Y2K computer conversion—probably the single most far-reaching and important management challenge of recent years. A host of GAO and IG reports laid out the extent of the Y2K problem and its root causes. The Executive Branch, particularly OMB, initially downplayed the problem. However, intense Congressional oversight ignited public concern and forced the Executive Branch to take the problem more seriously. Once that happened, the Executive Branch and Congress worked hand-in-hand to solve it. Action plans were developed, performance goals were set, and accountability was maintained through regular progress reports.

Management and oversight responsibility over the agencies was centralized in a special unit of the Executive Office of the President under the outstanding leadership of John Koskinen. Congress conducted systematic oversight and provided the funding and other legislative support needed to carry through on solutions.

While it would be hard to replicate the degree of public awareness and the sense of urgency that accompanied Y2K, the steps used to resolve it can readily be transferred to other problems like financial management. In essence, these steps require the Federal

Government to:

· Acknowledge fully and candidly the nature of the problem as well as its dimensions and consequences. This can be politically difficult, but it is absolutely essential.

· Identify the root causes of the problem and existing recommendations to address it. Most major problems, including financial management, are the subject of a host of GAO and IG reports and ‘‘open’’ (unresolved) recommendations. Often the same recommendations are reiterated year after year. Thus, a road map to solutions usually exists.

· Muster the will and ongoing commitment to solve the problem. To be effective, this must come from the highest leadership levels of the Administration and the agencies. As GAO observed: ‘‘We learned from the Year 2000 experience that proactive leadership at the highest levels of government is one of the most important factors in prompting attention and action on a widespread problem.’’ 25

· Establish specific and measurable performance goals to embody the commitments and systematically track them in order to assess progress and ensure follow through and accountability. As discussed below, the Results Act provides an excellent tool for setting goals and measuring success.

· Provide necessary support and incentives—both positive and negative—to implement solutions. This includes funding and other resources. It should also include rewards for progress and remedial actions (along with real consequences, as appropriate) for lack of progress.

RESTORING THE ‘‘M’’ IN OMB

One of the prerequisites to converting the above framework into concrete actions is strong central leadership, support, and oversight within the Executive Branch. This was a key element in resolving Y2K and is equally important for other systemic, crosscutting management challenges such as financial management. Unfortunately, the agency charged by law with this responsibility—OMB—has not been up to the task in recent years.

The former Bureau of the Budget was reconstituted as OMB by a Reorganization Plan during the Nixon Administration. 26 President Nixon’s message to Congress transmitting the Reorganization Plan stated that OMB would be ‘‘the President’s principal arm for the exercise of his managerial functions.’’ He added that ‘‘creation of the Office of Management and Budget represents far more than a mere change of name for the Bureau of the Budget. It represents a basic change in concept and emphasis, reflecting the broader management needs of the Office of the President.’’

Congress subsequently reaffirmed and expanded OMB’s management responsibilities on several occasions. Most notably, the CFO Act of 1990 established the Deputy Director for Management position at OMB as ‘‘the chief official responsible for financial management in the U.S. Government.’’ 27 During Senate consideration of this legislation, former Governmental Affairs Committee Chairman Glenn said of the new Deputy OMB Director for Management: ‘‘This high level official, appointed by the President, with the advice and consent of the Senate, will be responsible for the ‘M’ in OMB and for integrating and coordinating important financial management functions with other management and budget functions at OMB.’’ Senator Glenn stressed the importance of improving Federal financial management: Currently, there are hundreds of different accounting systems in the government, and few comply with generally accepted government accounting standards. These current practices do not show the actual costs of running the Federal Government. . . . There is no way that we in the Senate can fully determine the programmatic impacts of the legislative decisions we make on the basis of information reported. To make matters worse, often the information is reported in such an untimely manner that the decisions must be and are regularly made with dated, inaccurate information.

It is time that the Federal Government had a position, a Deputy Director for Management at OMB, that could be held accountable for these shortcomings. Someone who would be responsible for supplying the Executive Branch and the Congress with reliable, consistent, timely, and complete financial information, while focusing attention to the management of government, which is often lost in our battles over the budget. 28 The foregoing objectives have yet to be realized. Sadly, Senator Glenn’s summary of the government’s financial management problems in 1990 still holds true today. In numerous contexts, including addressing financial management problems, OMB has failed to fulfill its leadership role. According to many observers, the ‘‘M’’ has virtually disappeared from OMB. A 1994 reorganization of OMB, known as ‘‘OMB 2000,’’ shifted most of the agency’s resources to the budget side and greatly diminished its capacity to carry out its management functions. It is clear from OMB’s own Results Act plans and reports that the agency has little regard for its management responsibilities, including those specifically grounded in statute. Indeed, OMB’s most recent draft strategic plan contains nothing of substance addressing any of its management responsibilities. OMB’s failure to meet its management responsibilities has prompted calls for an entirely separate ‘‘office of management’’ in the Executive Office of the President. This is one way to achieve the central leadership on management that is so sorely needed. However, there is obvious power to linking management and budget decisions, as the expansion of OMB was intended to accomplish. OMB views its fundamental role as being ‘‘staff to the President.’’ 29

Therefore, in the final analysis, OMB’s enthusiasm for its management responsibilities is directly proportional to the President’s level of interest in management issues. If the incoming President gives sufficient priority to management improvements, OMB will surely follow suit.

SPECIFIC ACTIONS TO IMPROVE FINANCIAL MANAGEMENT

Within the above overall framework, there are many specific actions that can and should be taken to address financial management problems.

Establishment of specific performance goals and measures to resolve financial management problems. The Results Act provides an excellent mechanism for (1) establishing firm commitments to resolve financial management problems, through performance goals and (2) tracking progress against those goals through annual performance reports. Also, the annual government-wide performance plan required by the Results Act is well suited to establishing government-wide financial management improvement goals and re-enforcing the most important agency-specific goals. To their credit, a number of agencies have established some performance goals dealing with financial management. The most common goal is to get a clean opinion on the agency’s annual financial statements. It is also noteworthy that financial management is addressed in the ‘‘Priority Management Objectives’’ (so-called ‘‘PMOs’’) that appear in the President’s Annual Budget. The FY 2001 PMO on ‘‘improving financial management information’’ includes a performance goal that 22 of the 24 CFO Act agencies obtain clean opinions. 30 These specific performance goals are commendable. However, agencies and OMB should also establish Results Act performance goals to get at the underlying weaknesses that prevent them from using their financial systems for day-to-day management. As discussed previously, such goals would encourage agencies to invest their resources in making lasting improvements to their financial systems. One way to do this is to establish performance goals for compliance with FFMIA requirements. Such efforts will inevitably assist the agencies’ overall performance measurement efforts.

There are other areas in which agencies and OMB could adopt financial management performance-improvement goals. For example, the FY 2001 PMOs target additional government-wide problem areas that implicate financial management such as improving information technology and security and verifying the accuracy of Federal benefit determinations. For the most part, however, these PMOs lack specific performance goals and measures that could be used to track progress toward solving the problems they address.

Disclosure of erroneous payments, coupled with error-reduction targets. A powerful line of attack against the massive overpayment problems that plague the Federal Government is to disclose overpayment levels in annual financial statements and combine that disclosure with performance goals to reduce them. GAO found that only a few agencies now disclose their overpayments. Thus, it recommended that OMB:

Develop and issue guidance to executive agencies to assist them in (1) developing and implementing a methodology for annually estimating and reporting improper payments for major Federal programs and (2) developing goals and strategies to address improper payments in their annual performance plans. 31

By a letter dated November 5, 1999, Chairman Thompson urged OMB Director Lew to implement these GAO recommendations. In his January 2000 response, Director Lew agreed to issue guidelines for estimating overpayments. OMB has yet to follow through on that commitment.

Experience with the Medicare program demonstrates the value of measuring overpayments and then setting specific targets to reduce them. Using these combined techniques, Medicare has shown a dramatic overall reduction in its overpayments in recent years, even though overpayments rose again in FY 1999. The incoming

Administration should ensure that OMB meets its commitment to require disclosure of major overpayment problems in annual financial statements. If OMB fails to do so, the new Congress should legislate such a requirement.

Improved data sharing among agencies. Of course, the best solution to erroneous payments is not to make them in the first place. According to a recent GAO report, 32 inadequate or incorrect information often leads agencies to make erroneous eligibility determinations under various Federal programs, thus resulting in erroneous payments. Improved data sharing between Federal agencies, or between Federal agencies and other parties such as State agencies, could enhance eligibility decisions and thus reduce improper payments. For example, GAO found that hundreds of millions of dollars in Supplemental Security Income payments and payments under the Temporary Assistance for Needy Children (TANF) program could have been avoided or detected more quickly through enhanced data sharing.

The GAO report makes a number of recommendations to the Congress and the Executive Branch on ways to enhance data sharing. 33 Some of these recommendations involve policy judgments that balance improved data sharing against privacy and other considerations. Other recommendations are aimed at improving data sharing that agencies already are authorized to conduct. One recommendation is that OMB lead an inter-agency effort to develop an overall strategy to improve data sharing operations across all Federal benefit and loan programs.

The new Administration and Congress should carefully review the GAO recommendations for improved data sharing. Agencies also should take steps to improve their internal coordination and use of eligibility information already available to them. In this regard, the IG at HHS found that HHS paid millions of dollars for equipment and services allegedly provided to Medicare beneficiaries after the agency’s own records indicated that the beneficiaries had died. 34

One very specific but long overdue action is resolving the impasse over implementation of the Education-IRS data verification provision in the Higher Education Act Amendments of 1998. As discussed previously, this provision has remained in limbo since its enactment 2 years ago. Education, Treasury, and OMB have yet to take action either to make use of the existing authority or to seek any legislative changes that they deem necessary.

Implementing GAO and IG recommendations. Myriad GAO and IG reports exist on virtually all aspects of agency financial management problems. Many of these reports analyze the causes of the problems and make recommendations for corrective action. These reports and recommendations provide a wealth of information and advice that agencies should use to the greatest extent possible. OMB’s guidance to Federal agencies states that each agency should establish systems to assure the prompt and proper resolution and implementation of audit recommendations. 35 In addition, agencies are required by law to report to Congress on their actions in response to GAO recommendations. 36

In August 1999 letters to the heads of the major agencies, Chairman Thompson stressed the need for agencies to resolve and implement audit recommendations related to their major management problems, including financial management. He noted that many agencies continued to have a number of unresolved audit recommendations.

On the basis of the written responses to the Chairman’s letters and subsequent Committee staff meetings with agency officials, it appears that most agencies have made some progress in dealing with the IG and GAO recommendations. Some agencies, such as Interior, have established specific performance goals related to implementing audit recommendations. 37 Other agencies need to do a better job.

Financial management best practices. GAO recently studied the financial management practices and improvement strategies of private sector firms and State governments that are leaders in financial management. 38 Based on this study, GAO issued an ‘‘executive guide’’ that contains many case examples and strategies that can benefit the Federal Government. 39 Just a few of the strategies are:

· Establish and monitor specific performance goals and measures that reflect the finance operation’s role in meeting mission objectives.

· Benchmark financial management practices and processes with recognized leaders in order to measure performance and identify best practices.

· Place more emphasis on providing reliable and timely data that directly support strategic decision making and improvements in overall agency performance.

· Identify high-volume accounting processes or transactions that do not directly support the agency’s mission (low-value, low risk) and consolidate, streamline, outsource, or eliminate them.

Resources and incentives. Agencies that have fully acknowledged their financial management problems and have developed credible remedial actions deserve the support necessary to implement those actions. Obviously, this includes providing necessary funding. Overhauling or replacing ineffective financial management systems can be expensive. However, making the necessary investments is well worth the cost. Conversely, failing to make needed investments is penny-wise and pound-foolish. For example, the Agriculture Department’s financial systems are chronically incapable of producing useful information. Yet, Department officials told the Committee staff that fixing the problems would cost less than the amount left over each year from the Department’s unobligated funds. In addition to funding remedial actions that are well thought out, Congress needs to impose real consequences for agencies that aren’t improving. For example, funds that are available for performance bonuses, travel, and other administrative costs of the agency (particularly perks for political appointees) might be ‘‘fenced off ’’ for use only to improve financial management.

Recovery auditing. ‘‘Recovery auditing’’ is a valuable tool to both recoup overpayments resulting from financial management weaknesses and provide resources to remedy those weaknesses. Recovery auditing is a technique employed by many private sector firms that utilizes computer software programs to analyze contract and payment records in order to identify discrepancies between what was owed and what was paid. It focuses on obvious but inadvertent errors, such as duplicate payments or failure to get credit for applicable discounts and allowances.

The preceding recommendations need serious consideration and deliberation by key decisionmakers in Washington. If implemented, these recommendations could demonstrate significant movement in addressing the financial management challenges that face the Federal Government.

ENDNOTES

1. Financial Management: Agencies Face Many Challenges in Meeting the Goals

of the Federal Financial Management Improvement Act, GAO/T–AIMD–00–178

(June 6, 2000), pp. 1–2.

2. Auditing the Nation’s Finances: Fiscal Year 1999 Results Continue to Highlight

Major Issues Needing Resolution, GAO/T–AIMD–00–137 (March 31, 2000), pp.

10–11.

3. Id., p. 3.

4. Financial Management: Federal Financial Management Improvement Act Results

for Fiscal Year 1999, GAO/AIMD–00–307 (September 2000), pp. 18–19.

5. Id., p. 42.

6. Financial Management: Financial Management Challenges Remain at the Department

of Education, GAO/T–AIMD–00–323 (September 19, 2000), pp. 6–11.

7. The only three agencies that passed muster were the Energy Department,

NASA, and the National Science Foundation.

8. Financial Management: Federal Financial Management Improvement Act Results

for Fiscal Year 1999, op. cit. note 5, p. 2.

9. Id., pp. 29–30.

10. Id., p. 30.

11. Financial Audit: IRS’ Fiscal Year 1999 Financial Statements, GAO/AIMD–00–

76 (February 2000), pp. 13–14, 28–29.

12. Department of Defense: Progress in Financial Management Reform, GAO/T–

AIMD/NSIAD–00–163 (May 9, 2000), p. 1 (Emphasis supplied).

13. Financial Management: Increased Attention Needed to Prevent Billions in Improper

Payments, GAO/AIMD–00–10 (October 1999).

14. Id., p. 6.

15. Governmental Affairs Committee Press Release: Thompson Details $220 Billion

in Government Waste (January 24, 2000).

16. Financial Management: Improper Payments Reported in Fiscal Year 1999 Financial

Statements, GAO/AIMD–00–261R (July 27, 2000).

17. Treasury Department IG for Tax Administration, Management Advisory Report:

Administration of the Earned Income Credit, Ref. No. 2000–40–160 (September

2000), p. iii.

18. Ibid.

19. See Statement of Susan Gaffney before the Subcommittee on Housing and

Transportation of the Senate Banking Committee on Management and Performance

Issues Facing HUD (September 26, 2000), pp. 10–11.

20. Government Executive Daily Briefing, Agency Overpayments Rise Above $20

Billion, September 13, 2000.

21. Department of Education Office of Inspector General, Semiannual Report to

Congress No. 40, October 1, 1999-March 31, 2000, p. 15.

VerDate 11-MAY-2000 11:11 Nov 27, 2000 Jkt 000000 PO 00000 Frm 00021 Fmt 6633 Sfmt 6602 67613.TXT SAFFAIRS PsN: SAFFAIRS

18

22. Financial Management: Education’s Financial Management Problems Persist,

GAO/T–AIMD–00–180 (May 24, 2000), pp. 1, 3.

23. Observations on the Department of Education’s Fiscal Year 1999 Performance

Report and Fiscal Year 2001 Performance Plan, GAO/HEHS–00–128R (June 30,

2000), p. 2.

24. Section 484(q) of the Higher Education Act, as amended, 20 U.S.C. § 1091(q).

25. Financial Management: Federal Financial Management Improvement Act Results

for Fiscal Year 1999, op cit. note 5, p. 42.

26. Reorganization Plan No. 2 of 1970, 31 U.S.C. § 501 note.

27. 31 U.S.C. § 502(c).

28. 136 Cong. Rec. 35767–68.

29. See generally, OMB’s Draft Strategic Plan for FY 2001–2005 and a letter from

Sally Katzen dated August 8, 2000, transmitting the Draft Plan to Chairman

Thompson.

30. See Budget of the U.S. Government, FY 2001, pp. 294–295.

31. Financial Management: Increased Attention Needed to Prevent Billions in Improper

Payments, op cit. note 14, p. 42.

32. Benefit and Loan Programs: Improved Data Sharing Could Enhance Program

Integrity, GAO/HEHS–00–119 (September 2000).

33. Id., pp. 43–44.

34. Governmental Affairs Committee Press Release: Medicare Paying for Health

Care for the Dead, March 13, 2000.

35. OMB Circular A–50.

36. 31 U.S.C. § 720.

37. See Department of the Interior Fiscal Year 2001 Annual Performance Plan, p.

101.

38. The private sector organizations were Boeing, the Chase Manhattan Bank,

General Electric, Hewlett-Packard, Owens Corning, and Pfizer. The State governments

were Massachusetts, Texas, and Virginia.

39. Executive Guide: Creating Value Through World-class Financial Management,

GAO/AIMD–00–134 (April 2000).

http://hsgac.senate.gov/_files/rptmanagechallenge.pdf

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 21

(12)

- *Part I: Financial Management Issues

- Senator Thompson: Balancing Trade & Security in th...

- Vote Comparisons

- Senator Thompson's Amendment on Aviation Security ...

- Senator Thompson helped define the new Homeland Se...

- Oak Ridge Nuclear Plant Protection

- Floor Statement on China Nonproliferation Act

- Floor Statement 1 China Nonproliferation

- the implementation of legislation creating the Nat...

- *Report On Manangement Challenges facing Federal G...

- Thompson on $80 million wasted tax dollars

- Thompson Amendment On Homeland Security

-

▼

Apr 21

(12)

-

▼

April

(113)

Meet Senator Thompson

Saturday, April 21, 2007

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

2 comments:

Good day !.

You re, I guess , perhaps curious to know how one can reach 2000 per day of income .

There is no need to invest much at first. You may start to get income with as small sum of money as 20-100 dollars.

AimTrust is what you need

The firm represents an offshore structure with advanced asset management technologies in production and delivery of pipes for oil and gas.

Its head office is in Panama with structures around the world.

Do you want to become a happy investor?

That`s your choice That`s what you desire!

I`m happy and lucky, I started to take up real money with the help of this company,

and I invite you to do the same. If it gets down to select a correct companion who uses your funds in a right way - that`s it!.

I earn US$2,000 per day, and my first deposit was 1 grand only!

It`s easy to start , just click this link http://ataziqoxy.100megsfree5.com/kolaci.html

and go! Let`s take this option together to become rich

Good day, sun shines!

There have were times of hardship when I felt unhappy missing knowledge about opportunities of getting high yields on investments. I was a dump and downright stupid person.

I have never thought that there weren't any need in big initial investment.

Now, I feel good, I begin take up real money.

It's all about how to choose a proper partner who utilizes your money in a right way - that is incorporate it in real deals, and shares the profit with me.

You may ask, if there are such firms? I have to answer the truth, YES, there are. Please be informed of one of them:

http://theinvestblog.com [url=http://theinvestblog.com]Online Investment Blog[/url]

Post a Comment