Thompson Fights to Eradicate Tax Penalty on Public Servants

Thursday, July 11, 2002

Washington , DC - The Senate Finance Committee today approved an amendment, sponsored by Senator Fred Thompson (R-TN), that reduces a financial burden many presidential appointees face when they are required to divest their stock options as a condition of taking public office. The Thompson provision, which was included in the National Employee Savings and Trust Equity Act, removes the tax penalty on public servants by expanding the current certificate of divestiture program to include stock options under Investment Stock Option plans (ISO) and Employee Stock Purchase Plans (ESPP). Appointees can already be granted certificates when they sell shares of traditional stock.

"It is unfair to penalize willing public servants for complying with the law," Thompson said. "Especially now as we continue to fight a war on terrorism, we must work to ensure that the best and brightest of the nation’s leaders continue to be attracted to public service, instead of constructing blockades to discourage them from serving their country."

Conflict of interest statutes and ethics laws prohibit high-ranking government officials from holding a stake in companies that may be affected by their decisions. Therefore, many public servants are required to sell significant stock holdings before they can enter public office, regardless of their personal investment plans. Unfortunately, this can place a heavy tax burden on them simply for obeying the law.

To mitigate this penalty, Congress passed the Ethics Reform Act of 1989. This law contains a provision which allows ethics officials to grant a certificate of divestiture to appointees who are required to sell stock when they enter office. This allows the appointee to use the proceeds from the stock sale to purchase an approved investment without the immediate penalty of capital gains tax. The tax is deferred until the appointee decides to sell the approved investment holdings.

However, the certificate of divestiture program does not currently address ISO and ESPP stock options, which have become a common part of many corporate compensation packages. When appointees are required to divest their ISO or ESPP stock options without meeting the holding period requirements to obtain capital gains treatment, the gain on the sale is taxed as ordinary income, and not capital gains. The provision sponsored by Senator Thompson would expand the certificate of divestiture program to include all ISO and ESPP stock options.

"This amendment will end an unfair financial penalty on presidential appointees. While these top officials should always be held to the highest ethical standard, they shouldn’t have to pay heavily to get their jobs. We already have enough problems filling government’s top posts; we can do without this one. Today’s vote is a step in the right direction toward fixing the broken presidential appointments process," concluded Thompson.

http://hsgac.senate.gov/071102press.htm

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 22

(29)

- Thompson Bill to grant Attorney General Discretion...

- Thompson Fights to Eradicate Tax Penalty on Public...

- More on Thompson Homeland Security Amendment and I...

- Thompson advocates increased flexibility for Homel...

- Senator Thompson; Federal Management Reform and th...

- Thompson Amendment for Airline Security

- Thompson's 2001 Assessment of Federal Agencies

- House Adopts Thompson Aviation Security Amendment

- Thompson Legislation to Protect Federal Informatio...

- Thompson Federal Regulatory Improvement Act of 1998

- Thompson on IRS Accountability to Public

- Levin-Thompson Regulatory Improvement Act

- 1998- Thompson Calls for Arms and Dual-Use Export ...

- Congress Passes Thompson Legislation Promoting Pub...

- Thompson-Warner Bill to Allow Homeland Security Ag...

- Thompson Provision On Public Regulation Passes

- Thompson Applauds Mineta Airport Security Plan

- National Security Workforce Legislation

- *Preface from Thompson's Report into Financial Cam...

- *Recommendations from Senator Thompson's Investiga...

- Thompson's Freedom to Manage Package to Reform Gov...

- Thompson Amendment ensured to protect privacy on g...

- Companion to Management Issues Report

- Statement on Antrax through the Mail

- "Restoring the Balance" Award

- Statement on the Export Administration Act

- Comments on IRS Mismanagement of Funds

- Oped on the Future of the Independent Counsel Act

- Leadership Challenges in the 21st Century: Panetta...

-

▼

Apr 22

(29)

-

▼

April

(113)

Meet Senator Thompson

Subscribe to:

Post Comments (Atom)

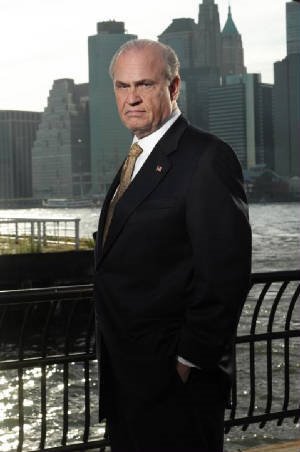

Fred Thompson

Former U.S. Senator (R-TN)

No comments:

Post a Comment