Government Accountability

REGULATORY REFORM

"Congress should bring more common sense into the regulatory process,? said Senator Thompson. ?Right now the Code of Federal Regulations is about 130,000 pages long, and takes up more than 21 feet of shelf space.? The regulations that fill these 200 volumes cost the average American family about $7,000 every year. ?Even well-intentioned laws can produce unsatisfactory results," Thompson said. ?We need a clean environment, safe products and safe medications. But if we regulate smarter, we can achieve our goals and make our government more effective, more efficient and more accountable than ever."

THE REGULATORY RIGHT-TO-KNOW ACT

In 1998, Congress passed Thompson?s regulatory accounting amendment as part of the fiscal year 1999 Omnibus Appropriations Act. The Thompson Amendment requires OMB to do a peer-reviewed report on the costs and benefits of regulatory programs, due in February 2000. The Thompson Amendment strengthened the prior Stevens regulatory accounting amendment, enacted in 1996, by requiring: (1) independent peer review of the report; (2) OMB guidelines to the agencies to ensure the credibility of the information; (3) more details on the costs and benefits of individual agency programs, to the extent feasible; and (4) information on the costs and benefits of paperwork requirements, including tax compliance.

S. 59, the "Regulatory Right-to-Know" Act of 1999, was introduced by Thompson on January 19, 1999 and is co-sponsored by the following Senators: Christopher Bond (R-MO), John Breaux (D-LA), Michael Crapo (R-ID), Judd Gregg (R-NH), Chuch Hagel (R-NE), Tim Hutchinson (R-AR), Mary Landrieu (D-LA), Blanche Lincoln (D-AR), Trent Lott (R-MS), Charles Robb (D-VA), William Roth (R-DE), Jeff Sessions (R-AL), Ted Stevens (R-AK), George Voinovich (R-OH).

This legislation will continue the requirement that OMB report to Congress on the costs and benefits of regulatory programs, which began in 1996 with the Stevens Amendment. S. 59 also adds to previous initiatives in several respects. First, it will finally make the regulatory accounting a permanent statutory requirement. Regulatory accounting will become a regular exercise to help ensure that regulatory programs are cost-effective, sensible, and fair. Second, this legislation will require OMB to provide a more complete picture of the regulatory system, including the incremental costs and benefits of particular programs and regulations, as well as an analysis of regulatory impacts on small business, governments, the private sector, wages and economic growth. OMB also will look back at the annual regulatory costs and benefits for the preceding 4 fiscal years, building on information generated under the Stevens Amendment. Finally, this legislation will help ensure that OMB provides better information as time goes on. Requirements for OMB guidelines and independent peer review should improve future regulatory accounting reports. Government has an obligation to think carefully and be accountable for requirements that impose costs on people and limit their freedom.

THE "REGULATORY IMPROVEMENT ACT," S. 746

On March 25, 1999, Senators Levin and Thompson reintroduced the "Regulatory Improvement Act," with broad bipartisan support. S. 746 requires agencies to issue regulatory analyses for major rules which include: (1) cost-benefit analysis examining regulatory alternatives; (2) risk assessment; (3) scientific or economic information relied upon in cost-benefut analysis and risk assessment; and (4) scientific information on substitution risks to health, safety, or the environment.

S. 746 would establish a framework for cost-benefit analysis and risk assessment of major rules and executive oversight of the regulatory process. Agencies would perform a cost-benefit analysis when issuing rules that cost $100 million or have other significant impacts. The agency would determine whether the benefits of the rule justify its costs; whether the rule is more cost-effective, or provides greater net benefits, than other regulatory options; and whether the rule adopts a flexible regulatory approach. If the rule does not do so, the agency would explain the reasons why it selected the rule, including any statutory provision that required the rule. If the rule addresses a risk to health, safety, or the environment, the agency would do a risk assessment to analyze the risk reduction benefits of the rule. Cost-benefit analyses for rules costing over $500 million and all covered risk assessments would undergo independent peer review. The Governmental Affairs Committee held hearings on the Regulatory Improvement Act on September 12, 1997 and February 24, 1998. S. 746 has been cosponsored by 7 Democrats and 10 Republicans.

THE TRUTH IN REGULATING ACT OF 2000

This legislation, which has been passed by the Senate, establishes a three-year pilot project to support Congressional oversight to ensure that important regulatory decisions are efficient, effective, and fair. Under the pilot project, the chairman or ranking member of a committee with jurisdiction over a particular federal agency may request the General Accounting Office (GAO) to review a proposed economically significant regulation. The GAO would then have 180 days to submit to the requesting committee a report evaluating the agency?s cost-benefit and regulatory analysis of the regulation. This report would help Congress to engage in oversight of the regulation.

S. 1198 was originally introduced as the Congressional Accountability for Regulatory Information Act of 1999 by Senator Richard Shelby. Senator Thompson introduced S. 1244, the Truth in Regulating Act of 1999. These two similar bills were synthesized along with changes made in collaboration with Senator Joe Lieberman, Ranking Member of the Governmental Affairs Committee. The resulting bill was approved by the Committee on November 3, 1999 and by the full Senate on May 9, 2000. The bill was referred to the House Committee on Government Reform on May 10, 2000.

In addition to Senator Thompson, S. 1198 is cosponsored by the following Senators: Robert Bennett (R-UT), Kit Bond (R-MO), John Breaux (D-LA), Chuck Hagel (R-NE), James Inhofe (R-OK), Robert Kerrey (D-NE), Mary Landrieu (D-LA), Blanche Lincoln (D-AR), Trent Lott (R-MS), Charles Robb (D-VA), William Roth, Jr. (R-DE), Ted Stevens (R-AK), and George Voinovich (R-OH).

FISCAL DISCIPLINE AND FAIRNESS

There are many public management issues that need to be addressed if the government is going to become more efficient and accountable to the taxpayers. Senator Thompson is working to ensure that the government operates with accountability, efficiency, and fiscal discipline. For example:

The Results Act, passed by congress in 1993, is designed to provide policy-makers and the public with systematic, reliable information about where federal programs and activities are going, how they will get there, and how we will know when they have arrived. Agencies have had mixed results complying with the reporting to be filed by March 31st of each year (link). Senator Thompson is working to ensure the successful implementation of the Results Act in order to hold federal agencies accountable for results.

Agencies are required, under the Chief Financial Officers Act, to report on their finiancial statements by March 1 of each year. Senator Thompson is working to ensure that agencies submit timely financial statements to ensure that federal operations have the benefit of basic information with which to manage the expenditure of taxpayer dollars. Without basic financial information, agencies cannot accurately and in a timely manner, measure the full cost and financial performance of programs, cannot effectively and efficiently manage their operations, and/or cannot ensure compliance with laws and regulations.

Congress passed into law the Federal Travel and Transportation Reform Act of 1998 which was reported out of the Senate Governmental Affairs Committee with a Thompson amendment. This bill will help the federal government better manage the $7 billion of travel expenses and save $90 million by requiring federal employees to use travel charge cards and streamlining the antiquated auditing procedures associated with federal travel expenses.

http://web.archive.org/web/20021006213211/thompson.senate.gov/text/accounts.html

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 28

(50)

- The Republican Dilemma

- Agriculture- official position

- War On Terror- official position 2002

- Biennial Budget- official position 2002

- Campaign Finance Reform- official position 2002

- Computer Security- official position 2002

- Education- official position 2002

- Federalism- official position 2002

- Government Accountability- official position 2002

- Government Waste, Fraud & Abuse- official position...

- National Defense- Official position 2002

- National Record of Accomplishments- official 2002

- Oak Ridge- official position 2002

- Armed Forces- official position 2002

- Presidential Appointment Process- official positio...

- Social Security- official position 2002

- Weapons of Mass Destruction- official position 2002

- Tax Relief- official position 2002

- Tennessee Preservation- official position 2002

- Tennessee Tourism & Travel- official position 2002

- Tennessee Valley Authority- official position 2002

- China Nonproliferation Act- official position 2002

- Veterans- official position 2002

- Working For Tennessee- 2002

- Fred Talks Sports

- Weekly Column 01-03-01

- Weekly Column 01-10-01

- Weekly Column 01-17-01

- Weekly Column 01-17-01

- Weekly Column 01-24-01

- Weekly Column 02-09-01

- Weekly Column 02-16-01

- Weekly Column 03-16-01

- Weekly Column 03-30-01

- Weekly Column 04-06-01

- Weekly Column 04-27-01

- Weekly Column 05-04-01

- Weekly Column 05-11-01

- Weekly Column 05-18-01

- Weekly Column 05-25-01

- Weekly Column 06-01-01

- Weekly Column 06-08-01

- Weekly Column 06-15-01

- Weekly Column 06-22-01

- Weekly Column 07-01-01

- Weekly Column 08-06-01

- Weekly Column 08-31-01

- Weekly Column 09-14-01

- Weekly Column 10-01-01

- Weekly Column 11-05-01

-

▼

Apr 28

(50)

-

▼

April

(113)

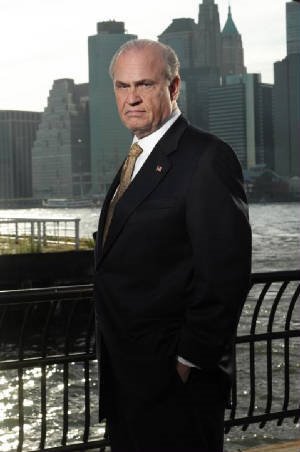

Meet Senator Thompson

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

No comments:

Post a Comment