TAX RELIEF FOR TENNESSEE IS A TOP PRIORITY

by

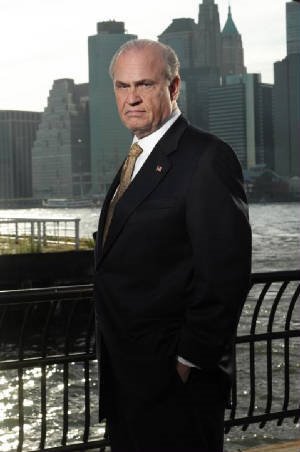

Senator Fred Thompson (R-TN)

May 11, 2001

Federal taxes are at an all time high, and folks in Tennessee and across America bear a heavy tax burden. They are taxed when they work, when they put gas in their cars, when they buy groceries, when they save for the future, and even when they die. Folks should be rewarded, not punished, for working hard, and we in Congress are trying to do just that.

Both the House and Senate recently agreed on a federal budget for the next fiscal year. The purpose of the budget is to serve as a road map for how we will fund America's priorities. Included in this budget are dollars that will eventually be directed to Tennessee for priorities such as national defense, education, national parks and roads, help for our farmers, and a host of other important priorities.

I am very pleased that the budget also allows for significant tax relief for all Tennesseans. Specifically, the budget calls for $1.35 trillion in tax relief over the next eleven years, beginning this year (2001). In the next few weeks, the Senate will begin to map out the specifics of this plan.

The plan included in the budget will reduce income tax rates for every American taxpayer, with the greatest benefit going to the lowest-income taxpayers. As structured, it would remove six million low-income families from the tax rolls altogether. In addition, the plan provides for an immediate economic stimulus of $100 billion in 2001 and 2002, and authorizes additional tax or debt relief if surpluses exceed expectations.

We will also be working to repeal the death tax and provide significant marriage penalty relief. Folks should not have to pay nearly $1,400 more in taxes each year simply because they are married. Eliminating the death tax will ensure that our family farms and small businesses can be passed on for generations to come.

Recently, we recognized what many have come to call "Tax Freedom Day." This day was designated to emphasize the fact that many taxpayers actually work from January until the month of May just to pay their taxes. In 1992, National Tax Freedom Day fell on April 18, but with taxes now taking a larger portion of income, Tax Freedom Day was on May 3 this year.

We must put a stop to this trend. It's just common sense. When we have excess cash flowing into Washington, and we have more than we need to operate the government, we should return a little back to the folks who earned it in the first place. If we leave it in Washington, it will get spent. This money belongs to hard-working Tennesseans and that is who should decide how to spend it.

The President and the Congress are committed to providing tax relief this year. That's good news for Tennessee

http://web.archive.org/web/20020626121746/thompson.senate.gov/press/2001/columns/051101.html

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 28

(50)

- The Republican Dilemma

- Agriculture- official position

- War On Terror- official position 2002

- Biennial Budget- official position 2002

- Campaign Finance Reform- official position 2002

- Computer Security- official position 2002

- Education- official position 2002

- Federalism- official position 2002

- Government Accountability- official position 2002

- Government Waste, Fraud & Abuse- official position...

- National Defense- Official position 2002

- National Record of Accomplishments- official 2002

- Oak Ridge- official position 2002

- Armed Forces- official position 2002

- Presidential Appointment Process- official positio...

- Social Security- official position 2002

- Weapons of Mass Destruction- official position 2002

- Tax Relief- official position 2002

- Tennessee Preservation- official position 2002

- Tennessee Tourism & Travel- official position 2002

- Tennessee Valley Authority- official position 2002

- China Nonproliferation Act- official position 2002

- Veterans- official position 2002

- Working For Tennessee- 2002

- Fred Talks Sports

- Weekly Column 01-03-01

- Weekly Column 01-10-01

- Weekly Column 01-17-01

- Weekly Column 01-17-01

- Weekly Column 01-24-01

- Weekly Column 02-09-01

- Weekly Column 02-16-01

- Weekly Column 03-16-01

- Weekly Column 03-30-01

- Weekly Column 04-06-01

- Weekly Column 04-27-01

- Weekly Column 05-04-01

- Weekly Column 05-11-01

- Weekly Column 05-18-01

- Weekly Column 05-25-01

- Weekly Column 06-01-01

- Weekly Column 06-08-01

- Weekly Column 06-15-01

- Weekly Column 06-22-01

- Weekly Column 07-01-01

- Weekly Column 08-06-01

- Weekly Column 08-31-01

- Weekly Column 09-14-01

- Weekly Column 10-01-01

- Weekly Column 11-05-01

-

▼

Apr 28

(50)

-

▼

April

(113)

Meet Senator Thompson

Saturday, April 28, 2007

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

No comments:

Post a Comment