TAX RELIEF FOR TENNESSEANS IS ON THE WAY

by

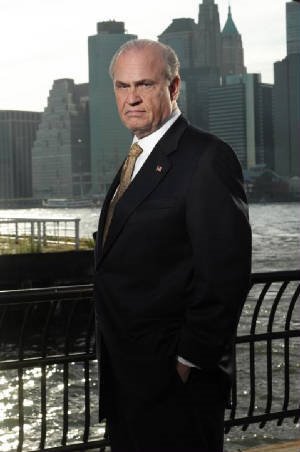

Senator Fred Thompson (R-TN)

June 1, 2001

For the last decade, the American people have seen the federal government take an increasing share of their personal income, and federal taxes are at an all-time high. I am pleased to say that help is on the way, as Congress recently approved the Tax Reconciliation Act of 2001, a historic tax relief plan. This bill, passed by both the House and Senate, and soon to be signed into law by President Bush, contains every major element of the President's original tax cut proposal.

The plan provides $1.35 trillion in tax relief over the next 11 years, cutting tax rates across the board, eliminating the death tax, providing relief from the marriage penalty, and doubling the child tax credit. It provides an immediate boost to our economy, puts money back in people's pockets this year, and provides tax relief to every American who pays income taxes.

I'm very pleased that the bill we passed cuts income tax rates across the board. Every income taxpayer gets a tax cut, rather than having Congress pick winners and losers based on government-sanctioned behavior.

Beginning this summer and throughout the fall, taxpayers will get refund checks from the federal government, and their tax bills will continue to go down over the next ten years. This year, single taxpayers will get a refund check of as much as $300, single parents will receive up to $500, and married taxpayers will get as much as a $600 refund check.

The Tax Reconciliation Act helps farmers, small business owners, and others by addressing the onerous death tax. Our bill repeals the tax in 2010 and provides some immediate relief as well. For example, the current estate tax exemption of $675,000 will increase to $1 million in 2002, and it continues to increase after that until it is completely repealed.

Saving for a child's education is not always easy, but the bill we passed will help parents save by increasing the limit on education savings account contributions to $2,000 a year and allowing the funds to be used for K-12 expenses. It permits tax-free distributions from state prepaid tuition plans, such as Tennessee Best, and allows private institutions to offer prepaid plans.

Some other key provisions include expanding the earned income credit and making the child credit refundable to put more money in the hands of millions of working families with children. In addition, the plan increases the adoption tax credit to $10,000, increases the child care tax credit, and creates a new tax credit for employers that provide child care facilities for their employees.

Personal saving in this country is at an all-time low. To make it easier for Americans to save for their retirement, the tax plan will increase the IRA contribution limit to $5,000 and allow for IRA catch-up contributions. It also will create a new low-income savers tax credit of up to $1,000 for contributions to an IRA or 401(k) plan. In addition, it enhances pension portability when Americans change jobs and simplifies pension rules for businesses and their employees.

In recent years, those of us who have tried to cut taxes have seen our efforts thwarted by President Clinton's veto pen, but this year we have achieved success. I believe this tax relief package is a an important step toward reducing the tax burden for Tennesseans. By doing so, we help to improve the quality of life for families working to make ends meet and set the stage for long-term economic growth.

http://web.archive.org/web/20020626122304/thompson.senate.gov/press/2001/columns/060101.html

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 28

(50)

- The Republican Dilemma

- Agriculture- official position

- War On Terror- official position 2002

- Biennial Budget- official position 2002

- Campaign Finance Reform- official position 2002

- Computer Security- official position 2002

- Education- official position 2002

- Federalism- official position 2002

- Government Accountability- official position 2002

- Government Waste, Fraud & Abuse- official position...

- National Defense- Official position 2002

- National Record of Accomplishments- official 2002

- Oak Ridge- official position 2002

- Armed Forces- official position 2002

- Presidential Appointment Process- official positio...

- Social Security- official position 2002

- Weapons of Mass Destruction- official position 2002

- Tax Relief- official position 2002

- Tennessee Preservation- official position 2002

- Tennessee Tourism & Travel- official position 2002

- Tennessee Valley Authority- official position 2002

- China Nonproliferation Act- official position 2002

- Veterans- official position 2002

- Working For Tennessee- 2002

- Fred Talks Sports

- Weekly Column 01-03-01

- Weekly Column 01-10-01

- Weekly Column 01-17-01

- Weekly Column 01-17-01

- Weekly Column 01-24-01

- Weekly Column 02-09-01

- Weekly Column 02-16-01

- Weekly Column 03-16-01

- Weekly Column 03-30-01

- Weekly Column 04-06-01

- Weekly Column 04-27-01

- Weekly Column 05-04-01

- Weekly Column 05-11-01

- Weekly Column 05-18-01

- Weekly Column 05-25-01

- Weekly Column 06-01-01

- Weekly Column 06-08-01

- Weekly Column 06-15-01

- Weekly Column 06-22-01

- Weekly Column 07-01-01

- Weekly Column 08-06-01

- Weekly Column 08-31-01

- Weekly Column 09-14-01

- Weekly Column 10-01-01

- Weekly Column 11-05-01

-

▼

Apr 28

(50)

-

▼

April

(113)

Meet Senator Thompson

Saturday, April 28, 2007

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

No comments:

Post a Comment