TAX FAIRNESS FOR TENNESSEE

by

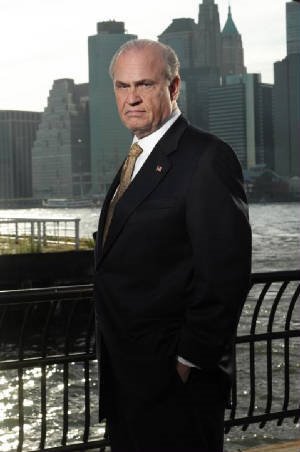

Senator Fred Thompson (R-TN)

March 30, 2001

Tennesseans are discriminated against under federal tax laws simply because our state chooses to raise revenue primarily through a sales tax instead of an income tax. Federal law enables taxpayers to deduct their state income tax from their federal tax liability, but not their state sales tax. That's unfair.

Therefore, residents of eight states are treated differently from residents of states that have an income tax. Six states ? Texas, Wyoming, Florida, South Dakota, Washington, and Nevada ? have no state income tax. Two states ? Tennessee and New Hampshire ? only impose an income tax on interest and dividends, but not wages. Tennesseans pay more than $750 million more in taxes to the federal government each year than they should because of this inequity in the tax code.

I have introduced legislation that will address this by allowing taxpayers to deduct either their state and local sales taxes or their state and local income taxes on their federal tax forms, but not both.

Prior to 1986, taxpayers were permitted to deduct all of their state and local taxes paid (including income, sales and property taxes) when computing their federal tax liability. The ability to deduct all state and local taxes is based on the principle that levying a tax on a tax is unfair. In 1986, however, Congress made dramatic changes to the tax code. The Tax Reform Act of 1986 significantly reduced federal tax rates on individuals. In exchange for these lower rates, Congress broadened the base of income that is taxed by eliminating many of the deductions and credits that previously existed in the code, including the deduction for state and local sales taxes. The deduction for state and local income taxes, however, was retained.

It's long past time to restore equity for persons living in states without an income tax. My legislation would do this in a fair and simple manner. Under the legislation, persons claiming a deduction for state and local sales taxes would simply have to refer to an IRS chart to determine the amount they could deduct. The amount of the deduction would be based on a taxpayer's income and family size. This way, taxpayers would not be burdened with keeping track of their receipts all year.

Passage of this legislation won't be easy, as only eight other states share Tennessee's situation, but it's an effort we must undertake. Similar legislation has been introduced in the House and the Tennessee delegation is working in a bi-partisan manner to generate support for our effort.

I believe that our federal tax laws should be neutral with respect to the treatment of state and local taxes. The current tax code is biased in favor of states that raise revenue through an income tax. I strongly support comprehensive reform of the tax code that will address issues such as neutrality, fairness and simplicity. As we work to reform the overall tax code, restoring equity in this area should be a part of the discussion.

http://web.archive.org/web/20021020105534/thompson.senate.gov/press/2001/columns/033001.html

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 28

(50)

- The Republican Dilemma

- Agriculture- official position

- War On Terror- official position 2002

- Biennial Budget- official position 2002

- Campaign Finance Reform- official position 2002

- Computer Security- official position 2002

- Education- official position 2002

- Federalism- official position 2002

- Government Accountability- official position 2002

- Government Waste, Fraud & Abuse- official position...

- National Defense- Official position 2002

- National Record of Accomplishments- official 2002

- Oak Ridge- official position 2002

- Armed Forces- official position 2002

- Presidential Appointment Process- official positio...

- Social Security- official position 2002

- Weapons of Mass Destruction- official position 2002

- Tax Relief- official position 2002

- Tennessee Preservation- official position 2002

- Tennessee Tourism & Travel- official position 2002

- Tennessee Valley Authority- official position 2002

- China Nonproliferation Act- official position 2002

- Veterans- official position 2002

- Working For Tennessee- 2002

- Fred Talks Sports

- Weekly Column 01-03-01

- Weekly Column 01-10-01

- Weekly Column 01-17-01

- Weekly Column 01-17-01

- Weekly Column 01-24-01

- Weekly Column 02-09-01

- Weekly Column 02-16-01

- Weekly Column 03-16-01

- Weekly Column 03-30-01

- Weekly Column 04-06-01

- Weekly Column 04-27-01

- Weekly Column 05-04-01

- Weekly Column 05-11-01

- Weekly Column 05-18-01

- Weekly Column 05-25-01

- Weekly Column 06-01-01

- Weekly Column 06-08-01

- Weekly Column 06-15-01

- Weekly Column 06-22-01

- Weekly Column 07-01-01

- Weekly Column 08-06-01

- Weekly Column 08-31-01

- Weekly Column 09-14-01

- Weekly Column 10-01-01

- Weekly Column 11-05-01

-

▼

Apr 28

(50)

-

▼

April

(113)

Meet Senator Thompson

Saturday, April 28, 2007

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

No comments:

Post a Comment