Tax Relief

Americans are being taxed at the highest rate since World War II. The typical family pays 39 percent of its income in taxes at the federal, state and local level -- more than they spend on food, clothing and shelter combined. Senator Thompson believes that is simply too high, and he has been a leader in moving tax relief legislation through the Senate.

Senator Thompson is a member of the powerful Committee on Finance, which has jurisdiction over all tax issues. From this position, he helped write the largest tax cut bill in history ? the Taxpayer Refund and Relief Act of 1999. This bill would have provided Americans with $792 billion of tax relief over 10 years. Specifically, the bill would have reduced the burden on all taxpayers by cutting tax rates across-the-board. It would have provided couples with relief from the marriage penalty tax. It would have provided relief to Americans who have worked hard to build up a business or farm and want to pass it along to their children by repealing the death tax. It would have made the cost of health insurance more affordable. It would also have provided increased incentives for Americans to save for their retirement and their children's education. Unfortunately, that bill never became law, because it was vetoed by President Clinton.

In 2000, Senator Thompson is continuing his efforts to deliver tax relief to hard-working Americans. He has helped draft and move a number of tax bills through the Senate. For example, the Senate has passed the Affordable Education Act of 2000. This bill would help families save for their children's education by increasing the amount they can contribute to an education savings account from the current $500 to $2,000 per year, by allowing education savings account funds to be used for K-12 expenses (such as tutors, computers or uniforms), and by making withdrawals from state and private pre-paid tuition plans tax-free. In addition, this bill would help state and local governments modernize existing schools or build new schools by easing the tax-exempt bond rules.

The Senate has passed a package of tax cuts for small businesses. This bill would immediately increase to 100 percent the deductibility of health insurance for the self-employed, repeal the 0.2 percent temporary federal unemployment payroll tax (FUTA), make permanent the Work Opportunity Tax Credit (WOTC), increase from 50 to 80 percent the amount of business meal expenses small business are permitted to deduct, reform the pension laws to make it easier for small businesses to offer an employee pension plan, and allow small businesses to deduct immediately purchases of equipment of up to $30,000 per year.

The Senate has also passed the Patients' Bill of Rights Plus Act, which includes tax provisions aimed at increaseing access to health insurance by reducing the cost of health care coverage. Specifically, this bill would expand Medical Savings Accounts (MSAs) so that they are available to all Americans, increase to 100 percent immediately the deductibility of health insurance for the self-employed, and make long term care insurance deductible.

Finally, Senator Thompson is working to pass legislation that would provide all American couples with relief from the marriage penalty tax. Senator Thompson believes that the marriage penalty unfairly discriminates against hard-working families and should be eliminated. That is why he supports the Marriage Tax Relief Act of 2000, which was passed by the Finance Committee and is now pending before the full Senate. This bill would increase the standard deduction for married couples to make it twice the deduction for a single taxpayer. It would expand the 15 and 28 percent tax brackets for those who file joint returns to twice the income level for single filers. It would raise the income phase-out limit for the Earned Income Tax Credit by $2,500 to remove the marriage penalty for the lowest income Americans. This bill would also provide middle income taxpayers with permanent relief from the alternative minimum tax (AMT) by allowing families to benefit from various tax credits (such as the $500 child tax credit) without being caught up in the AMT.

Senator Thompson believes that the present tax code has become to intricate, too complicated, and, in many ways, simply unfair. That is why he is a strong supporter of both tax relief and fundamental tax reform. By enacting reforms that simply our tax laws and reduce the tax burden on most Americans, Senator Thompson believes we can strengthen our families, stimulate economic growth, help create new jobs, and return some common sense to our system of taxation.

http://web.archive.org/web/20020617213830/thompson.senate.gov/text/taxref.html

TIME TO PUT UP OR SHUT UP

Click a Topic to Read and Research and then scroll down

- 2008 Campaign (2)

- awards (3)

- Commentary (1)

- Federal Law (28)

- Federalism (2)

- Foreign Policy (12)

- Fred Thompson (114)

- interview (1)

- official position (22)

- Qualifications (1)

- Record (1)

- reports (7)

- speeches (3)

- Tennnessee Law (14)

- videos (8)

- Vote Comparison (1)

- writings (32)

Click A Post In The Archive- star=full report. Click topic to bring up in new page

-

▼

2007

(116)

-

▼

April

(113)

-

▼

Apr 28

(50)

- The Republican Dilemma

- Agriculture- official position

- War On Terror- official position 2002

- Biennial Budget- official position 2002

- Campaign Finance Reform- official position 2002

- Computer Security- official position 2002

- Education- official position 2002

- Federalism- official position 2002

- Government Accountability- official position 2002

- Government Waste, Fraud & Abuse- official position...

- National Defense- Official position 2002

- National Record of Accomplishments- official 2002

- Oak Ridge- official position 2002

- Armed Forces- official position 2002

- Presidential Appointment Process- official positio...

- Social Security- official position 2002

- Weapons of Mass Destruction- official position 2002

- Tax Relief- official position 2002

- Tennessee Preservation- official position 2002

- Tennessee Tourism & Travel- official position 2002

- Tennessee Valley Authority- official position 2002

- China Nonproliferation Act- official position 2002

- Veterans- official position 2002

- Working For Tennessee- 2002

- Fred Talks Sports

- Weekly Column 01-03-01

- Weekly Column 01-10-01

- Weekly Column 01-17-01

- Weekly Column 01-17-01

- Weekly Column 01-24-01

- Weekly Column 02-09-01

- Weekly Column 02-16-01

- Weekly Column 03-16-01

- Weekly Column 03-30-01

- Weekly Column 04-06-01

- Weekly Column 04-27-01

- Weekly Column 05-04-01

- Weekly Column 05-11-01

- Weekly Column 05-18-01

- Weekly Column 05-25-01

- Weekly Column 06-01-01

- Weekly Column 06-08-01

- Weekly Column 06-15-01

- Weekly Column 06-22-01

- Weekly Column 07-01-01

- Weekly Column 08-06-01

- Weekly Column 08-31-01

- Weekly Column 09-14-01

- Weekly Column 10-01-01

- Weekly Column 11-05-01

-

▼

Apr 28

(50)

-

▼

April

(113)

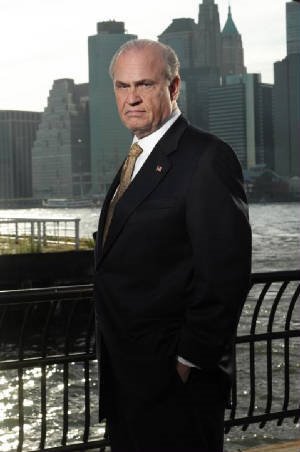

Meet Senator Thompson

Subscribe to:

Post Comments (Atom)

Fred Thompson

Former U.S. Senator (R-TN)

1 comment:

My family always say that I am killing my time here at net, but I know I am getting

familiarity every day by reading thes fastidious content.

Visit my weblog soft drinks

Post a Comment